Financialisation has pervasive effects on our societies, and the FESSUD project has been analysing and seeking to understand those effects, to probe the interrelationship of financialisation and financial crisis and to develop policy agendas.

The final annual conference of the FESSUD project was held on September 27th/28th 2016. The first day was devoted to presentation and discussion of some of the main research findings coming from the project. The second day focused on policy recommendations and debates. In this final conference it was only possible to present a small range of the research results and policy recommendation of the FESSUD project. The working papers and other publications including policy briefs from the FESSUD project provide the full range of the work of our project.

The first session opened with Andrew Brown (Leeds University Business School) speaking on ‘Variegated financialisation’, followed by Malcolm Sawyer (Leeds University Business School) on ‘Understanding finance and financialisation’ (also see related paper on financialisation and economic performance). These presentations elaborated on the processes of financialisation over the past three decades and the variegated nature of these processes.

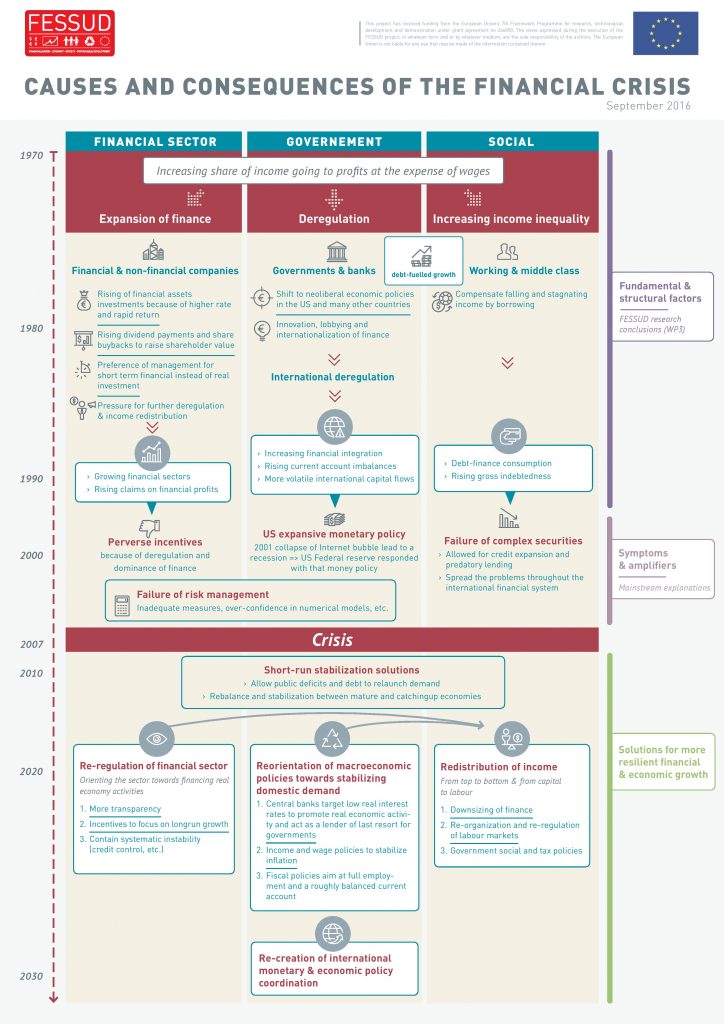

Session 2 opened with Eckhard Hein (HWR Berlin) providing an overview of the work of FESSUD on the causes and consequences of the financial crisis, the mechanisms generating crisis and the relationships between financialisation and financial crisis. He developed the implications for a more resilient financial and economic system (see presentation and related papers). Jesus Ferreiro (University of the Basque Country) then spoke on some of the ‘Macroeconomic lessons for EU’ which arose from the FESSUD work. He covers the impact of the crisis on European countries and the consequences for macroeconomic policy. The disparities in national economic performances and models of growth and implications for European integration were also covered (see related papers).

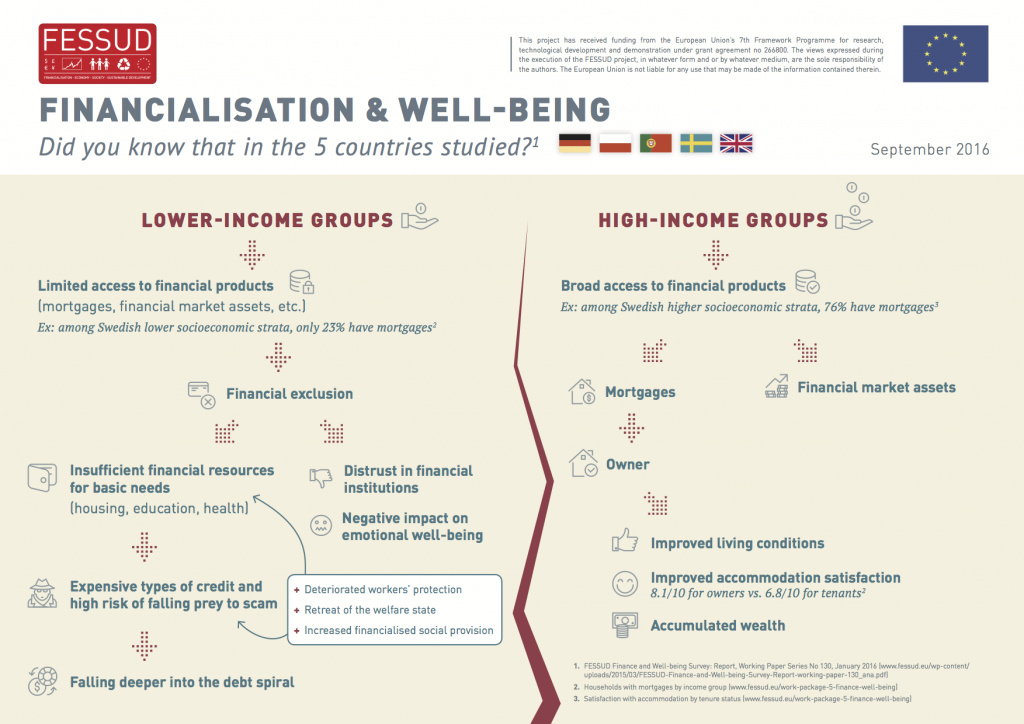

In session 3, Ana Cordeiro Santos (CES University of Coimbra) spoke on the theme of ‘De-financialising social well-being’. Her talk opened with consideration of household participation in debt and financial asset markets, which have been significant elements in processes of financialisation and in some countries the generation of financial crisis. She was able to discuss some aspects of the financialised systems of provision, notably in housing (see prelated paper). Financialisation has been a global phenomenon. The issue of ‘The impact of financialisation on developing countries‘ was addressed by Terry McKinley (SOAS, University of London). He covered empirical analysis of and recommendations for new ways of global engagement, and the impact of financialisation on the major emerging economies.

Session 4 focused on financialisation and environmental sustainability. Alessandro Vercelli (University of Siena) opened with a presentation in which he related the financialisation since 1980 as involving worsening of sustainability, and asked whether the future would be any better (see PPT and related papers). Eric Clark (Lund University) focused on ‘Geographies of Financialisation and Sustainability’ (see PPT presentation).

This day focused on a range of policy proposals arising from the FESSUD project with commentators from outside of the FESSUD project discussing the proposals.

The day opened with session 1 on Regulation and macroeconomic policies.

Jan Kregel (Tallin University of Technology) addressed the ‘Role of regulation in avoiding crisis’, with Benoit Lallemand (Finance Watch) as the commentator (see Jan Kregel’s related papers). A broad overview of the wide range of work within FESSUD which related to the macroeconomic policies of the Economic and Monetary Unionwas given by Jerome Creel (French Observatory of Economic Conjunctures (OFCE)) with Richard Corbett (Member of the European Parliament – S&D) and Maria Demertzis(Bruegel) as commentators (see related papers).

The second session related to Financialisation and sustainability: environment and development. Two presentations from FESSUD partners provided policy suggestions for the financing of green investment. Alessandro Vercelli (University of Siena) focused on ‘The role of green investment’ with proposals to close the invest gap through development of EU green banking network (see related paper) and Andrew Gouldson (University of Leeds) outlined ‘Innovative Financing Models for Low Carbon Transitions’ (see related paper). Professor Michael Grubb (UCL and Ofgem) and Molly Scott-Cato (Member of the European Parliament – Greens/EFA) discussed the two presentations.

Jan Toporowski (SOAS – University of London) addressed issues of ‘Finance policy in a financialising world’ (see related papers). Lord Meghnad Desai (House of Lords, UK) provided commentary.

The key note address was given by Professor Frank Vandenbroucke (University of Amsterdam, formerly Belgian Minister for Social Affairs and Pensions) on the theme of ‘A European Social Union. Unduly idealistic or inevitable?’ He considers that defining the EMU’s social objective is a necessity rather than a luxury, and argues that the EMU forces upon the member states: a shared conception of labour market flexibility, symmetric guidelines on wage cost competitiveness and institutions that can deliver long-term sustainability of pensions. Ann Pettifor (PRIME, London) opened the discussion on this.

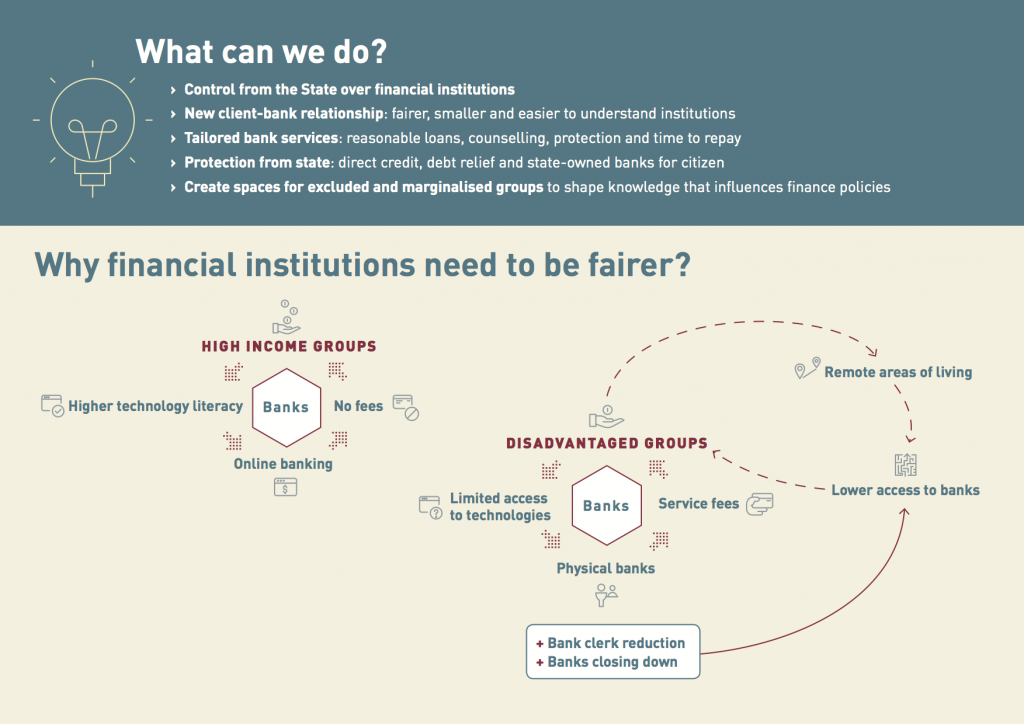

In Session 4 Magda Tancau (European think & do tank Pour La Solidarité) talked on ‘alternative forms of finance to better serve social well-being’, drawing on the results of focus groups conducted in nine countries with disadvantaged and excluded groups on their experiences with the financial sector. Stefanie Schulte (RWGV) in her commentary spoke on ‘How German Cooperative Banks Serve SMEs and Local Communities’.

Giuseppe Fontana (University of Leeds) provided a general overview on the foresight exercises on the future of finance carried within the FESSUD project (see PPT presentation). Jesus Ferreiro (University of the Basque Country) highlighted some of the features for the Delphi study (see related paper). Professor Anastasia Nesvetailova (City Political Economy Research Centre) provided her insights into the future of finance.

The final session was a roundtable under the heading of ‘Finance better serving economy and society’. Irene van Staveren (Think tank Sustainable Finance Lab, NL), Brigitte Young (University of Műnster), Robert Pollin (University of Massachusetts Amherst) and Benoit Lallemand (Finance Watch) discussed questions on the future of finance.